Every December, business owners face the same question.

What should I buy before the end of the year?

Trucks get upgraded. Tools get replaced. Equipment gets purchased because the tax timing makes sense. And while those decisions matter, many contractors overlook one investment that does more than look good on paper.

Asset protection.

- Not next year.

- Not when something goes wrong.

- Now

Because the equipment decisions you make in December are the ones that determine how smoothly January actually starts.

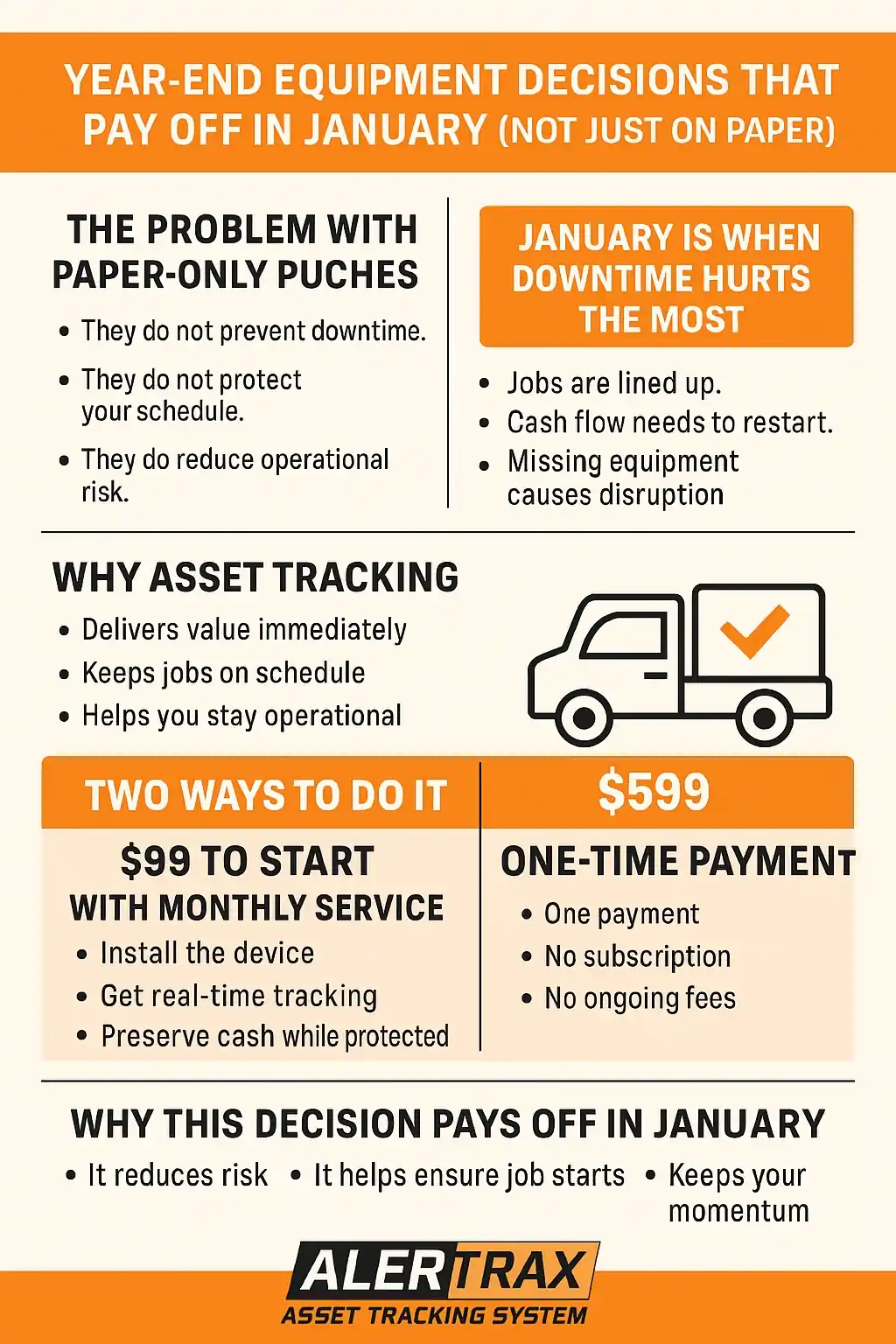

The Problem With “Paper-Only” Year-End Purchases

- They do not prevent downtime.

- They do not protect your schedule.

- They do not reduce operational risk.

And when January hits, those purchases often do nothing to stop the most common disruption contractors face early in the year.

Missing equipment.

January Is When Downtime Hurts the Most

The first few weeks of January matter more than people realize.

- Crews are coming back.

- Jobs are lined up.

- Customers expect momentum.

- Cash flow needs to restart quickly.

When a trailer goes missing or equipment is stolen during the holidays, January turns into recovery mode instead of production mode.

- Lost mornings turn into lost weeks.

- Insurance calls replace job starts.

- Crews wait while tools are replaced.

That kind of disruption wipes out far more value than most year-end purchases ever create.

Why Asset Tracking Is a January Win, Not Just a December Expense

Protecting equipment is one of the few year-end decisions that delivers value immediately.

The moment a tracker is installed, it starts working.

The moment something moves that should not, you know.

That changes outcomes.

- Instead of discovering a theft days later, you can act in real time.

- Instead of scrambling in January, you keep jobs on schedule.

- Instead of reacting, you stay operational.

That is not a tax benefit.

That is a business benefit.

And it shows up the first week of January.

Two Ways to Do It, Depending on How You Run Your Business

Not every business approaches purchases the same way. That is why AlerTrax offers two straightforward options.

Option 1: $99 to Start With Monthly Service

This option works well if you prefer to spread costs over time or want to start protecting assets with minimal upfront expense.

- You install the device.

- You get real-time tracking and alerts.

- You preserve cash while staying protected.

- It is simple and flexible.

Option 2: $599 One-Time Payment

This option is designed for businesses that prefer to buy equipment outright.

- One payment.

- No subscription.

- No ongoing fees.

You install it once and track your asset without worrying about another line item every month.

For many businesses, this option also fits well into year-end equipment planning and Section 179 discussions with their accountant.

Why This Decision Pays Off in January

Unlike many year-end purchases, asset tracking does not sit on a shelf.

- It actively reduces risk.

- It protects the equipment you already own.

- It helps ensure January starts with work, not damage control.

That is the difference between buying something because you should and buying something because it actually helps.

The best year-end equipment decisions do more than reduce taxes.

- They protect uptime.

- They protect schedules.

- They protect momentum.

If January matters to your business, then protecting your equipment before December ends is not optional. It is strategic.

👉 Protect your equipment before the year ends and start January on your terms. Choose $99 to start with monthly service or $599 for a one-time payment and get tracking in place now.

Learn more at www.buyalertrax.com

- Simple hardware.

- Real protection.

- And a year-end decision that actually pays off.